Vikran Engineering IPO has generated significant buzz in the market with its Grey Market Premium (GMP) of ₹18 as of August 25, 2025. The Engineering, Procurement, and Construction (EPC) company is set to launch its ₹772 crore public offering tomorrow, August 26, 2025, with strong investor interest already visible in the grey market. This comprehensive guide covers everything you need to know about the Vikran Engineering IPO, from GMP trends to allotment procedures.

What is Vikran Engineering IPO GMP Today?

Current GMP Status and Market Sentiment

The Vikran Engineering IPO GMP currently stands at ₹18 per share, indicating strong market confidence in the company’s prospects. This premium suggests that investors are willing to pay ₹18 above the upper price band of ₹97, translating to an estimated listing price of ₹115 per share.

“The current GMP of ₹18 represents approximately 18.56% potential listing gains for investors who get allotment at the upper price band,” according to market analysts.

GMP Trend Analysis

The grey market premium for Vikran Engineering has shown consistent strength over the past week:

- August 25, 2025: ₹18 (Current)

- August 23, 2025: ₹20

- August 22, 2025: ₹18

- August 21, 2025: ₹21

- August 20, 2025: ₹21

The Kostak rates have also remained strong, ranging from ₹1,900 to ₹2,800, indicating active trading interest in the grey market.

Read More: Vikram Solar IPO Listing Date August 26: Check GMP, Share Price & Allotment Status

Key IPO Details and Important Dates

Primary IPO Information

Vikran Engineering Limited is launching a mainboard IPO worth ₹772 crores, making it one of the significant public offerings in the EPC sector this year.

| IPO Details | Information |

|---|---|

| Company Name | Vikran Engineering Limited |

| Issue Size | ₹772.00 Crore |

| Fresh Issue | ₹721.00 Crore |

| Offer for Sale | ₹51.00 Crore |

| Price Band | ₹92 – ₹97 per share |

| Face Value | ₹1 per share |

| Lot Size | 148 shares |

| Issue Type | Book Building IPO |

Critical Dates Timeline

| Event | Date |

|---|---|

| IPO Opening Date | August 26, 2025 |

| IPO Closing Date | August 29, 2025 |

| Allotment Date | September 1, 2025 |

| Refund Initiation | September 2, 2025 |

| Demat Credit | September 2, 2025 |

| Listing Date | September 3, 2025 |

Investment Categories and Minimum Requirements

The IPO follows standard SEBI allocation norms:

| Investor Category | Allocation | Minimum Investment |

|---|---|---|

| Retail Investors | Minimum 35% | 1 lot (148 shares) – ₹14,356 |

| Non-Institutional Investors | Maximum 15% | 14 lots (sHNI) – ₹2,00,984 |

| Qualified Institutional Buyers | Maximum 50% | As per regulations |

Retail investors can apply for a maximum of 13 lots (1,924 shares) worth ₹1,86,628.

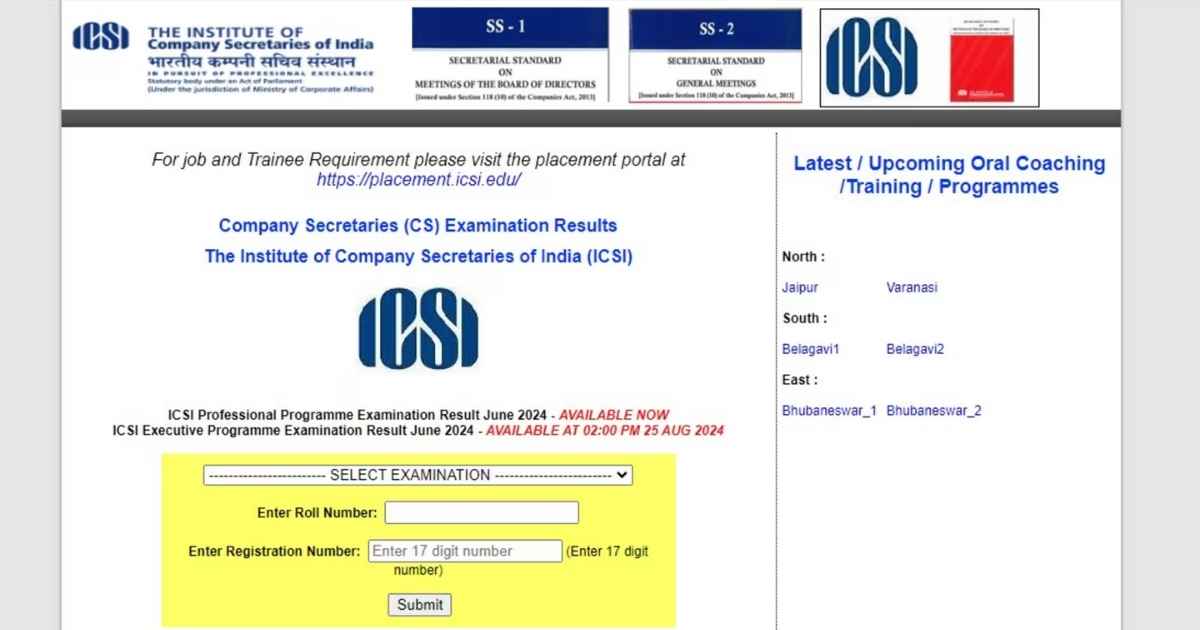

Read More: ICSI CS Result June 2025 Declared: Professional & Executive Results Out – Check Your Scores Now!

How to Apply for Vikran Engineering IPO

Online Application Process

Investors can apply for the Vikran Engineering IPO through multiple convenient methods:

1. UPI-Based Application (Recommended)

Through Broker Platforms:

- Login to your broker’s app or website

- Navigate to the IPO section

- Select “Vikran Engineering IPO”

- Enter the number of lots and price

- Submit your UPI ID for payment

- Approve the UPI mandate when received

Important: The UPI limit for IPO applications is ₹5 lakhs, which covers both retail and HNI categories.

2. ASBA (Application Supported by Blocked Amount)

Through Net Banking:

- Login to your bank’s net banking portal

- Go to “IPO Application” under ASBA services

- Select Vikran Engineering IPO

- Fill in bid details and submit

Offline Application Method

Investors can also apply offline by:

- Collecting the IPO application form from authorized banks or brokers

- Filling in personal details, bid information, and UPI ID

- Submitting the form to registered intermediaries

Key Application Requirements

- Demat Account: Mandatory for all applicants

- PAN Card: Required for identity verification

- Bank Account: Linked with UPI ID or ASBA facility

- Valid UPI ID: For online payments (format: name@bank)

How to Check Vikran Engineering IPO Allotment Status

When to Check Allotment Status

The allotment status for Vikran Engineering IPO will be available on September 1, 2025. Investors can check their status through multiple official channels.

Method 1: Check on Registrar Website (Bigshare Services)

Bigshare Services Private Limited is the official registrar for this IPO:

Steps to Check:

- Visit the official Bigshare IPO portal:

https://www.bigshareonline.com/ipo_Allotment.html - Select “Vikran Engineering Limited IPO” from the dropdown

- Choose your preferred option:

- PAN Number

- Application Number

- Demat Account Number

- Enter the required details

- Submit to view your allotment status

Method 2: Check on BSE Website

BSE Allotment Portal Process:

- Visit:

https://www.bseindia.com/investors/appli_check.aspx - Select “Equity” under Issue Type

- Choose “Vikran Engineering Limited IPO” from dropdown

- Enter Application Number and PAN

- Complete captcha and click “Search”

Method 3: Check on NSE Website

NSE Verification Process:

- Go to:

https://www.nseindia.com/products/dynaContent/equities/ipos/ipo_login.jsp - Select the IPO from dropdown menu

- Enter Application Number, PAN, and captcha

- Click “Search” to view status

Method 4: Third-Party Platforms

Several reliable platforms offer allotment checking services:

- IPO Ji App/Website:

www.ipoji.com/ipo-allotment-status - Angel One: Through their trading app IPO section

Read More: 2025 Renault Kiger: Price, Features, and All You Need to Know

Registrar Contact Information

For queries related to allotment, contact Bigshare Services:

About Vikran Engineering Limited

Company Overview and Business Profile

Vikran Engineering Limited is a fast-growing Indian Engineering, Procurement, and Construction (EPC) company that has established itself as a key player in India’s infrastructure development sector.

Founded: 2008, with current management taking control in November 2014

Key Business Segments:

- Power Transmission & Distribution: Construction of high-voltage transmission lines up to 765kV

- Water Infrastructure: Underground water distribution, surface water extraction, overhead tanks

- Railway Infrastructure: Track electrification and traction systems

- Solar EPC: Expanding into renewable energy projects

Geographic Presence and Scale

Vikran Engineering has established operations across 22 states in India, with major presence in:

The company operates over 100 site locations across India with real-time monitoring through SAP systems.

Recent Financial Performance

Strong Revenue Growth:

Profit Growth:

The company has achieved a CAGR of 32.17% in revenue from FY2023 to FY2025.

Key Competitive Advantages

“Our core business strategy has always been delivering projects ahead of schedule,” states the company management.

Strategic Strengths:

- Robust Order Book: ₹2,044.31 crores as of March 31, 2025

- Asset-Light Model: Reduced fixed costs through equipment rental

- Diversified Portfolio: Presence across power, water, and railway sectors

- Strong Execution Capability: Track record of timely project delivery

Read More: MG Windsor EV 2025 Price, Launch Date, Features, How to Book Online in India?

Investment Analysis and Market Outlook

Financial Health Assessment

Key Financial Ratios (as of March 2025):

| Metric | Value |

|---|---|

| P/E Ratio | 22.88 |

| EPS | ₹4.24 |

| ROE | 16.63% |

| ROCE | 23.34% |

| EBITDA Margin | 17.50% |

| Market Cap | ₹2,501.74 Crores |

Industry Position and Growth Prospects

According to a CRISIL report, Vikran Engineering has delivered stronger revenue growth over FY23-25 than its industry peers in the EPC sector. The company operates in high-growth infrastructure segments:

Market Opportunities:

- Government Infrastructure Push: Increased focus on power transmission and rural electrification

- Railway Modernization: Expansion of electrified railway networks

- Water Infrastructure: Growing demand for water distribution systems

- Renewable Energy: Entry into solar EPC market

Risk Factors to Consider

Potential Challenges:

- Working Capital Intensive: EPC business requires significant working capital

- Government Dependency: Heavy reliance on government and PSU projects

- Execution Risks: Project delays could impact profitability

- Market Competition: Intense competition in EPC sector

Expert Recommendations

Based on the financial metrics and market position, analysts suggest that Vikran Engineering shows promise for long-term investors interested in India’s infrastructure growth story. However, investors should consider their risk appetite and investment horizon.

Read More: Google Pixel 10 Packed With Tensor G5 AI Power, Camera Upgrades, and 7-Year Updates

Frequently Asked Questions (FAQs)

1. What is the current Vikran Engineering IPO GMP?

The current Vikran Engineering IPO GMP stands at ₹18 per share as of August 25, 2025. This indicates an estimated listing price of ₹115, representing potential gains of approximately 18.56% over the upper price band.

2. When does the Vikran Engineering IPO open and close?

The Vikran Engineering IPO opens for subscription on August 26, 2025 and closes on August 29, 2025. It’s a 3-day subscription window for all investor categories.

3. What is the minimum investment required for retail investors?

Retail investors need to invest a minimum of ₹14,356 for 1 lot containing 148 shares. The maximum investment for retail category is 13 lots (1,924 shares) worth ₹1,86,628.

4. How can I check my Vikran Engineering IPO allotment status?

You can check allotment status starting September 1, 2025 through:

- Bigshare Services (registrar):

bigshareonline.com - BSE Portal:

bseindia.com/investors/appli_check.aspx - NSE Portal: NSE IPO verification page

- Broker platforms: Through your trading app

5. What is the listing date for Vikran Engineering IPO?

Vikran Engineering shares will be listed on BSE and NSE on September 3, 2025.

6. Can I apply for the IPO using UPI?

Yes, you can apply using UPI payment through broker platforms or mobile apps. The UPI limit for IPO applications is ₹5 lakhs, which covers both retail and HNI categories. You need a valid UPI ID linked to your bank account.

7. Who is the registrar for Vikran Engineering IPO?

Bigshare Services Private Limited is the official registrar. For queries, contact:

8. What is the company’s main business?

Vikran Engineering is an EPC (Engineering, Procurement, and Construction) company specializing in:

- Power transmission and distribution (up to 765kV)

- Water infrastructure projects

- Railway electrification

- Solar EPC projects

9. Is the Vikran Engineering IPO oversubscribed?

The subscription data will be available during the bidding period (August 26-29, 2025). Given the strong GMP of ₹18, market analysts expect healthy subscription levels across all categories.

10. What are the key risks associated with this investment?

Primary risks include:

- Working capital intensive EPC business model

- Dependency on government and PSU projects

- Project execution and delivery risks

- Competitive pressure in the EPC sector

11. How do I apply if I don’t have a UPI ID?

You can apply through ASBA (Application Supported by Blocked Amount) using your bank’s net banking portal under the IPO application section. This doesn’t require a UPI ID.

12. What happens if I don’t get allotment?

If you don’t receive allotment, the refund process will begin on September 2, 2025. The blocked amount in your bank account will be unblocked and made available for other transactions.