The income tax filing deadline for AY 2025-26 has been extended to September 15, 2025. Before filing your ITR, getting your Form 16 is essential for accurate tax filing.

What is Form 16 and Why Do You Need It?

Form 16 is your TDS certificate that shows how much tax your employer deducted from your salary during FY 2024-25. It has two important parts:

Part A: Contains employer details, your PAN, and total TDS deducted quarterly

Part B: Shows detailed salary breakup, deductions, and final tax calculation

“Form 16 simplifies ITR filing by providing all necessary income and tax details in one document”

Read More: MPESB Excise Constable Exam Date 2025 Out! 253 Posts – Check New Schedule

How to Download Form 16: Step-by-Step Guide

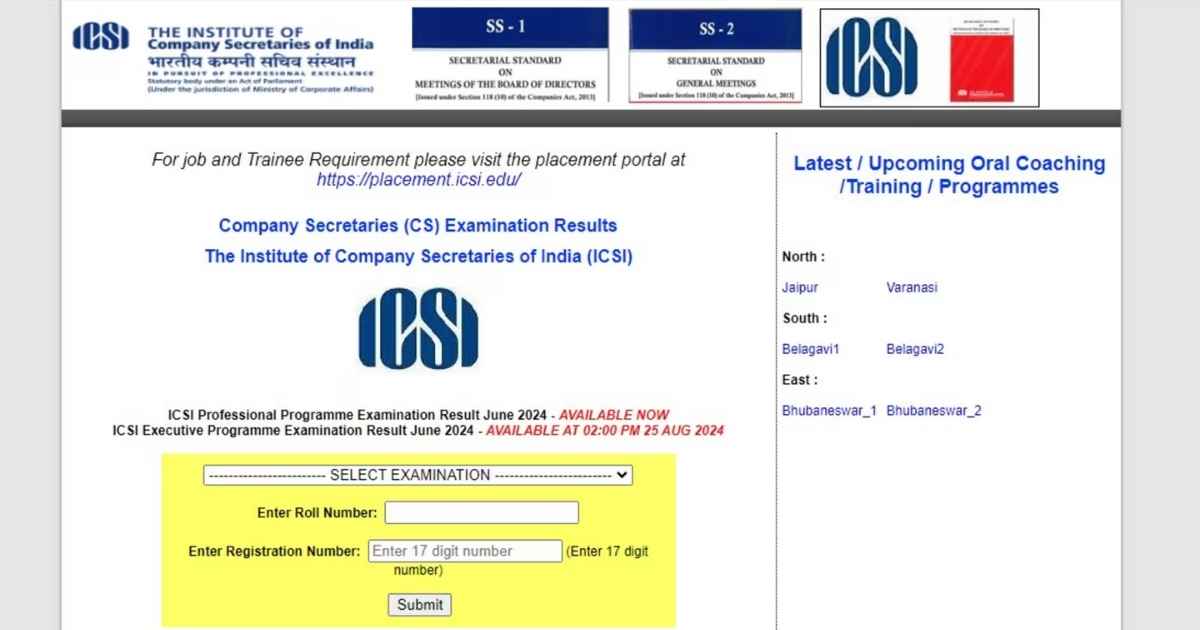

For Employers (TRACES Portal):

Step 1: Visit https://www.tdscpc.gov.in/ and login with User ID, Password, and TAN

Step 2: Go to ‘Downloads’ tab and select ‘Form 16’

Step 3: Choose financial year and PAN details (single or bulk download)

Step 4: Enter provisional receipt number from Q4 TDS return acknowledgment

Step 5: Provide challan details and tax deduction information

Step 6: Submit request – Form 16 will be available within 24-48 hours

Step 7: Download .txt file and convert to PDF using TRACES converter utility

For Employees:

Important: Employees cannot download Form 16 directly. Your employer must provide it to you by June 15, 2025.

Key ITR Filing Dates for AY 2025-26

| Taxpayer Category | Due Date |

|---|---|

| Individuals/HUF (Non-audit) | September 15, 2025 |

| Audit Cases | October 31, 2025 |

| Belated Return | December 31, 2025 |

Read More: HDFC Bank Makes History: First Ever 1:1 Bonus Issue Doubles Your Shares!

Penalties for Late Filing

Late Filing Fee (Section 234F):

Interest Charges (Section 234A):

“Filing early gives you more time to make corrections until December 31, 2025”

Important Things to Remember

- Mandatory Issuance: Employers must issue Form 16 by June 15

- Multiple Employers: Get separate Form 16 from each employer you worked with during FY 2024-25

- Form 12BA: Required additionally if you received perquisites

- Digital Signature: Ensure your Form 16 has valid digital signature for authenticity

- Cross-Verification: Match Form 16 details with your Form 26AS

Read More: Anlon Healthcare IPO GMP Today: Listing Date, Share Price & Allotment Status Check 2025

FAQ Section

Q: Can I file ITR without Form 16?

A: Yes, you can use salary slips and Form 26AS, but Form 16 makes filing easier and more accurate.

Q: What if I don’t receive Form 16?

A: Contact your employer immediately. They face ₹500/day penalty for delayed issuance.

Q: Can I download Form 16 using my PAN?

A: No, only employers can download from TRACES. Employees receive it from employers.

Q: What’s the difference between Form 16 and Form 16A?

A: Form 16 is for salary TDS, while Form 16A covers non-salary income like interest, rent, etc.

Q: Is Form 16 mandatory for loan applications?

A: Yes, most banks require Form 16 as income proof for loan processing.

Conclusion

With the ITR filing deadline extended to September 15, 2025, ensure you have your Form 16 ready. Remember, late filing attracts penalties, so prepare early. Contact your employer if you haven’t received your Form 16 yet, as it’s crucial for accurate income tax filing india 2025.